Mapping U.S. Chip Company Exposure to China

Calculating US Semiconductor Firm Dependence on, and Presence in, China.

BLUF: This post analyzes financial filings from 15 of the largest publicly traded U.S. chip companies from 2016-20 to determine their exposure to the Chinese market. It finds that U.S. semiconductor firms on average derive 31% of their net revenue from sales to China, though this number can reach as high as 60% for certain individual firms. This post also catalogues notable U.S. semiconductor firm facilities in China and the value of those facilities. Revenue from, and facilities in, China present commercial opportunities and regulatory liabilities for U.S. chip companies as policymakers in the U.S. and China maintain a keen interest in this industry.

Introduction:

There have been a lot of headlines the last few years about how tariffs, export controls, and U.S.-China trade tensions in general will result in a loss of U.S. firm market share in China, limit the ability of U.S. chip firms to reinvest profits derived from sales to China in R&D to stay competitive, and accelerate the decoupling of the U.S. and Chinese semiconductor industries:

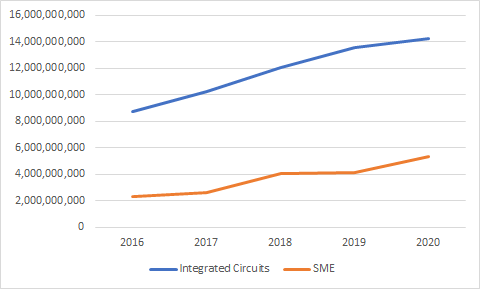

However, these headlines and fears are misplaced, at least for now. From 2016 to 2020, during the backdrop of the largest trade war since the 1980s, Chinese imports of U.S.-origin semiconductors and semiconductor manufacturing equipment (SME) essentially doubled:

This is mildly surprising, considering that semiconductors were subject to tariffs on both sides of the trade war, U.S. export controls targeted Chinese chip firms/end users etc, and all the uncertainty that this trade war caused. But these statistics actually understate how absolutely fantastic the last 5 years of business in China have been for U.S. semiconductor companies.

Careful analysis of these companies’ 10-Ks, especially their declared net revenue by region and their declared property, plants, and equipment (PPE) by region, directly illustrate their exposure to, and reliance on, the Chinese market. Doing business with and in China has been extremely lucrative for most U.S. chip firms these past five years.

U.S. Semiconductor Company Revenue from China

With few exceptions, U.S. semiconductor companies have maintained or increased the percent of net revenue they derive from China. A sample of 15 publicly traded U.S. chip companies across the semiconductor value chain (design, SME, fab, and ATP) finds that on average these companies derived 32% of their net revenue from sales to China in 2016 and that number has only declined to 31% as of 2020. Qualcomm (59%), Qorvo (49%), Texas Instruments (48%), Marvell (48%), and Broadcom (45%) are the five firms whose average net revenue from China was highest from 2016-20. Its worth stating the obvious here: each of these companies derives ~half their revenue from sales to China.

U.S. Chip Firm Percent of Net Revenue Derived from China, 2016-20

Among these companies, there are firms that have seen steady revenue, companies that have seen decreasing revenue, and companies that have seen increasing revenue from China.

Steady Revenue

In some cases, firms saw their revenue from China remain flat from 2016-20: companies like Intel saw their net revenue from China remain relatively low and steady, going from 24% in 2016 to 26% in 2020. In other cases, this is a high but steady figure: companies like Qualcomm have gone from 57% in 2016 to 60% in 2020. This is interesting because it suggests relatively steady demand for their products in the midst of a period of time where it was quite tumultuous to be a chip firm in the middle of the U.S. and China.

Decreasing Revenue

Several U.S. firms saw their revenue from China decline dramatically from 2016-20. Marvell (57% to 40%), Qorvo (61% to 34%), Broadcom (54% to 33%), and Micron (43% to 11%) were among these. First, its worth pointing out that all of these firms, except Micron, still derive 1/3rd of their total annual revenue from sales to China, even after a 5-year period of relative decline. Second, its worth pointing out that each of these firms is experiencing declines from an extremely high base. In general, it really isn’t sustainable for a company to derive 61% of its revenue from one country (Qualcomm being a clear exception) so some of this decline could be deliberate corporate de-risking (or just creative accounting changes). Third, it could also be that major Chinese customers of companies like Qorvo designed out some of their products in the past 5 years, resulting in lower sales. Finally, the declines Micron experienced seem like an outlier and are likely attributable to increasing Chinese memory chip purchases from SK Hynix and Samsung (Micron’s two main competitors, both of whom have large and recently-expanded memory fabs in China), not necessarily an increase in domestic Chinese HQ’d company memory chip production displacing Micron’s sales in-country.

Increasing Revenue:

Several U.S. companies saw their revenue from China increase substantially from 2016-20. Texas Instruments (45% to 55%), Applied Materials (21% to 32%), Lam Research (18% to 31%), and KLA (14% to 26%) were among these. These numbers understate the dramatic increase in these firms’ revenue from China. Zooming out the camera a bit to include all 15 of these companies, there are some big numbers. Though many of these companies started from a “low” base in 2016, comparing the change in the actual $USD China net revenue in 2016 vs actual $USD China net revenue in 2020 is striking.

Percent Change in Net Revenue Derived from China, 2016-20

In particular, the percent change in revenue from China between 2016 and 2020 for companies like KLA (248%), Nvidia (239%), and Lam Research (197%), with the backdrop of the trade war, is just stunning. On the flip side, Marvell and Qorvo appear to have dramatically reduced the amount of net revenue they derived from China when comparing 2016 to 2020 numbers. Micron remains and outlier.

UPDATE: an astute reader points out that in 2016, Micron reported “ship to location” and in 2020, they reported “reported based on geographical location of customers HQ.” So the outlier numbers described above and below are attributable to a reporting change. The reader suggests Micron’s revenue from China was probably between 8-15% over this 5 year period.

One important caveat here is that all the firms’ listed above, except for SME firms, are selling chips in to China but they have no idea where those chips go after that point. It could be that their chips are assembled in to a computer or smartphone and then re-exported to Germany or South Africa. It could be that their chips are assembled in to an Xbox and stay in China. These firms just report China net revenue based on customer ship-to location. Not necessarily the final destination of their chips. This caveat though is not relevant to SME firms, which are selling equipment directly to Chinese end user customers and its all staying in-country. Its worth looking at these SME firm numbers a little more closely:

U.S. SME Firm Sales to China

Semiconductor manufacturing equipment companies like KLA, Lam Research, Applied Materials, and Teradyne have been the big winners from 2016-20 with respect to China revenue. All saw their revenue from China go up by more than 100% from 2016-20. This is primarily due to Chinese construction of advanced fabs and Chinese firms’ inability to make the SME needed to fill these advanced fabs. Demand for these firms’ SME has just gone through the roof:

Applied Materials saw its revenue from China grow from $2.25 billion in 2016 (21% of its total revenue) to $5.45 billion in 2020 (32% of its total revenue).

Lam Research saw its revenue from China grow from $1 billion in 2016 (18% of its total revenue) to $3 billion in 2020 (31% of its total revenue).

KLA saw its revenue from China grow from $430 million in 2016 (14% of its total revenue) to $1.49 billion in 2020 (26% of its total revenue).

Below is a (slightly dated and incomplete) list of China’s foundry and memory chip production in the last few years (and thus projects that will need SME from these companies). Note that most of these projects are still under construction, though some are probably on hold or delayed (Tsinghua Unigroup filed for bankruptcy etc.) It takes 2-4 years to build a fab once the permitting (which can take another couple years) is approved. Demand for SME in China looks high for the foreseeable:

U.S. Semiconductor Firm Facilities in China

In addition to deriving a large part of their revenue from China, many U.S. semiconductor firms maintain substantial physical operations in China. Historically, one way to guarantee market access in China was for multinational corporations to build factories that promise to serve the Chinese market (every industry did this from planes, to trains, to automobiles). Interestingly, however, the trend seems to be that these firms’ investments in China are steady to declining (unlike their sales to China, which were clearly steady to increasing).

For a variety of reasons, there are a dwindling number of fabs operated by U.S.-headquartered companies in China. Notably, Intel recently divested its Dalian fab in a sale to SK Hynix, though the company still maintains a large ATP facility in Chengdu. Of this sample of 15 publicly traded U.S. chip companies, the only U.S. integrated device manufacturer with a fab left in China is Texas Instruments. Several U.S. firms however maintain substantial assembly, test, and/or packaging facilities in China and a few SME firms also have significant manufacturing operations at factories in China, notably KLA and Teradyne.

Looking at the value of these investments as it is presented in financial disclosures (generally under “long-lived assets” or “property, plant, and equipment (PPE)”), the exposure of these firms’ to the Chinese market becomes more quantifiable.

Percent of U.S. Chip Firms’ Property, Plants, and Equipment in China, 2016-20

There are several interesting trends to point out here: the value of the Texas Instruments fab in China is steady and TI hasn’t invested much in the facility these past five years (valued at $370 million in 2020). The value of Intel’s PPE in China plummeted following the sale of its Dalian fab to SK Hynix and it now reports “only” $851 million of PPE in China, a rough proxy for the value of its remaining ATP facility in-country. ON made a huge investment in its Chinese facilities in 2018 (its reported PPE jumped from $246 million in 2017 to $547 million in 2018) but has since returned to reporting a “normal” PPE amount of around $225 million in China. Micron appears to be letting its ATP facility in China coast.

These numbers are also interesting when juxtaposed with these firms’ reported PPE in the United States:

Percent of U.S. Chip Firms’ Property, Plants, and Equipment in U.S., 2016-20

First, and most obviously, this chart shows that Amkor essentially owns no physical assets in the United States ($6 million in 2020). It has a large ATP facility in Shanghai and similarly large facilities spread around SE Asia. It is a U.S. company in name only when it comes to physical assets. Notably, Micron, ON, and Western Digital also have relatively little PPE in the U.S., indicative of the fact that the vast majority of their fabs and manufacturing work is done in places other than the U.S. and China (all three have big fabs spread around Taiwan, Singapore, Malaysia, and Japan). Conversely, the vast majority of Qorvo, Intel and TI’s assets are concentrated in the U.S.

Conclusion

There has been a lot of talk the last few years about the effect of trade wars, export controls, and U.S.-China friction on the semiconductor industry. This basic analysis shows that, at least for this sample of firms, U.S. chip company operations w/r/t China have been largely uninterrupted. In fact, for the vast majority of companies the last 5 years of business in China have been truly outstanding financially. U.S. chip firms have seemingly weathered the turbulent past 5 years without too much trouble.