Betting the House: Leveraging the CHIPS Act to Increase U.S. Microelectronics Supply Chain Resilience

Welcome to Semi-Literate, a guide to the chip industry through the lens of public policy.

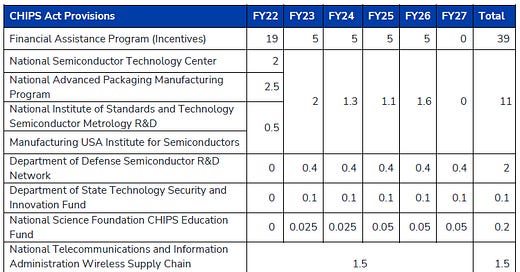

In August 2022, the CHIPS and Science Act appropriated over $52 billion to protect and promote the domestic U.S. semiconductor industry. Coverage of the CHIPS Act has primarily focused on the $39 billion in incentives allocated to subsidize the construction of new semiconductor fabrication facilities in the United States. However, the CHIPS Act also authorizes an investment tax credit as well as billions of dollars allocated to increase production and innovation in other associated parts of the microelectronics supply chain. This includes specific provisions related to manufacturing mature technologies, advanced packaging, a research and development network, information and communications technology security, workforce support, and wireless supply chain innovation. If appropriately allocated, the funds provided by these provisions present the United States with a once-in-a-generation opportunity to increase microelectronics supply chain resilience far beyond re-shoring semiconductor fabrication.

Introduction

While the vast majority of CHIPS Act funds are understandably focused on re-shoring semiconductor manufacturing capacity, more attention should be paid to the $15.2 billion made available for other microelectronics-related initiatives. Importantly, the CHIPS Act provides the relevant executive branch agencies with significant leeway to implement its many provisions. Agencies should use this flexibility in a manner that maximizes overall semiconductor supply chain resilience. Additionally, agencies can use this flexibility to focus CHIPS Act funds on parts of the semiconductor supply chain that were not necessarily explicitly called out in the legislation itself.

Spending $39 billion to re-shore leading-edge logic and memory manufacturing will do little to materially increase U.S. semiconductor supply chain resilience if accompanying efforts to re-shore and near-shore the broader ecosystem are not made. For example, if the CHIPS Act funds the construction of leading-edge semiconductors at an Arizona facility but those very semiconductors still have to be made using materials sourced from competitor countries and, once fabricated, sent to Asia for assembly, test, and packaging (ATP) before they can be used, then the resiliency of the U.S. semiconductor supply chain is not meaningfully increased by this act.

Upstream materials used in semiconductor fabrication include highly purified elements (such as aluminum and copper), chemicals (such as tin-oxide photoresist), common gases (like nitrogen and helium), and specialty electronic-grade gases (such as tungsten hexafluoride). Downstream materials used in semiconductor ATP again include certain common and electronic-grade gases as well as bonding wire, ceramics, substrates, lead frames, and resins. There are few, and in some cases no, U.S.- headquartered suppliers of many of the aforementioned materials. In many instances, even where there is a U.S.-headquartered supplier for a material, they frequently are producing or sourcing the materials from facilities located overseas, typically in Asia.

The downstream semiconductor ATP ecosystem is also almost entirely located in, and dominated by, countries and firms in Asia. Because many of the same geographic concentration risks threaten both semiconductor fabrication and ATP, efforts aimed at re-shoring semiconductor fabrication will not increase supply chain resilience if there is no commensurate effort to re-shore semiconductor ATP. However, U.S. efforts to re-shore ATP must contend with challenging economics. ATP is a labor-intensive and low-margin sub-segment of the semiconductor industry. Construction costs and labor rates are significantly higher in the United States than Asia, and the current U.S. workforce lacks the skills to meet these industries’ needs. U.S. policymakers will need to carefully consider how to re-shore or near-shore capacity in light of these realities. Adding to this complexity, construction of new fabs may introduce demand shocks that upstream and downstream suppliers are not prepared to meet.

Upstream Chokepoints: The Materials Ecosystem

There are a wide variety of materials used to make semiconductors. One semiconductor manufacturing equipment company estimates that 66 of the 118 elements in the periodic table are, or have been, used by the semiconductor industry to fabricate devices. The U.S. Geological Survey’s list of critical minerals includes 35 minerals, of which 30 are relevant to semiconductor manufacturing. Many materials go through supplemental processing to meet the stringent purity and performance requirements associated with semiconductor manufacturing, and U.S. capacity for this synthesis and purification is generally lacking. For example, while there are current U.S. suppliers of sulfuric acid and isopropyl alcohol (IPA), there are no U.S. suppliers of ultra-high purity sulfuric acid and IPA suitable for advanced semiconductor manufacturing.

The most prominent chemicals and gases used in semiconductor manufacturing include atmospheric gases, specialty gases, fluoropolymers, photoresists and photoresist ancillaries, chemical mechanical planarization slurries, and deposition materials. One study found that over four hundred chemical products were used in a semiconductor factory. In almost all cases, there are fewer than five suppliers of these specialty chemical products globally. Many products are produced by large multinational corporations like Linde (Ireland), Air Liquide (France), BASF and Merck (Germany), JSR and Shin-Etsu (Japan), Entegris and Dupont (United States) that make these chemicals and gases at facilities outside the United States.

Though these firms are headquartered in the United States or allied countries, they maintain a considerable production footprint in Asia in general, and China in particular. For example, Linde estimates its property, plants, and equipment in China are second in value only to its U.S. assets, while Air Liquide invested $170 million to expand China-based production of ultra-pure gases for semiconductor manufacturers in 2021. The reason for this presence in China is due to the increasing demand from semiconductor firms operating in China, but also the supply that China’s other industrial assets offer. Frequently, these chemicals and gases are indirectly produced and captured as byproducts of other industrial operations. Notably, the production of rare gases such as krypton and xenon are dependent on air separation units co-located with steel manufacturing. One industry association reports the semiconductor industry gets 80 percent of its supply of krypton and xenon from China and Ukraine, which in turn source most of their supply from Russia. Again, purity requirements dictate that even commercial off-the-shelf versions of these products must undergo supplemental processing, further constraining supply and the number of vendors.

In addition to the supply of these materials, gases, and chemicals already being complicated and constrained, the CHIPS Act also may introduce a demand shock. One industry analysis estimated that there needs to be a 37 to 49 percent increase in supply of all semiconductor grade wet chemicals over the next four years to meet the anticipated demand stemming from new fab construction in the United States. Given that most of the global supply of these materials, chemicals, and gases already resides outside the United States, it is important that the U.S. policymakers attempt to leverage CHIPS Act funds to increase domestic or allied production capacity to meet anticipated demand.

There are already some initial signs that the CHIPS Act is indirectly increasing material availability in the United States. Several of TSMC’s Taiwanese-based suppliers have announced their intention to establish facilities in Arizona near its new fab, which is scheduled to begin production in 2024 . Sunlit Chemical, a Taiwanese supplier of electronics grade chemicals, announced a $100 million facility to produce “hydrofluoric acid and other high purity grade industrial chemicals used in the manufacturing of semiconductors” in early 2022. While TSMC’s presence in Arizona appears to be incentivizing some materials suppliers to co-locate and increase domestic production, a recent application by TSMC to create a Foreign Trade Zone near its Phoenix fab lists roughly 100 “foreign-status” materials and chemicals not produced in the U.S.

While materials suppliers already have some market-based incentives to co-locate with their fab customers, U.S. policymakers should ensure that fab projects that take receipt of CHIPS Act funds include clear commitments from their suppliers to increase domestic production in areas where chokepoints remain. For example, policymakers could encourage SEMCO, a Samsung subsidiary and key supplier of substrates used in advanced packaging, to establish production in Texas near Samsung’s existing foundry. As will be described in the following section, the U.S. domestic production of substrates is insufficient to meet current and forecast demand, and firms in Asia dominate in this sub-market. This necessitates that policymakers craft incentives to attract leading firms back to the United States.

Downstream Chokepoints: The ATP Ecosystem

U.S-based ATP capacity is roughly 3 percent of total global capacity, and no U.S. firms lead in the supply of packaging materials. There is low to no capacity for production of leadframes, bond wires, ceramics, substrates, resins, and die attach materials outside of specific defense use cases. The lack of an ATP ecosystem in the United States is due to a multi-decade trend of semiconductor manufacturers choosing to locate these facilities in Asia due to favorable costs and proximity to electronics assembly firms. The result of this trend is that roughly 81 percent of global ATP capacity is concentrated in Asia, and firms in Japan, China, and Taiwan maintain dominant market shares for nearly all ATP materials, especially substrates and printed circuit boards.

Substrates and PCBs

On top of the lack of overall ATP capacity in the United States, currently there are no commercially and technologically competitive U.S. suppliers of the printed circuit boards and substrates necessary to integrate a finished semiconductor in an electronic device. The lack of a U.S. source of these products and services means that the vast majority of U.S.-fabricated semiconductors still must be sent overseas to Asia for ATP.

If a complete electronic assembly is a house (see figure above), PCBs form the foundation while substrates are the plumbing and framing. Once a chip has been fabricated, it is packaged on a printed circuit board using substrates to protect and connect the chip(s) to the electronic device. There are an extremely limited of number of substrate and printed circuit board suppliers in the United States, and their products cannot compete with Asian firms in terms of scale, quality, or cost. One industry analyst assessed that “the United States is 20 years behind Asia in PCB manufacturing technologies necessary for next-generation electronics applications and 30 years behind in the capability to manufacture the PCB-like substrates necessary for advanced microelectronics packaging.” If this deficit is not remedied, the gap between U.S. capabilities and industry-leading capabilities will expand despite efforts to re-shore semiconductor fabrication.

Specific chokepoints in the back end of the semiconductor supply chain abound. No U.S. substrate suppliers rank in the top 20 by market share and 95 percent of leading suppliers are located in Asia. Importantly, Ajinomoto build-up film (ABF, made primarily by firms in Japan and Taiwan), a single-source substrate intensively consumed in packaging 5G, HPC, and AI semiconductors, is almost exclusively produced in Asia and has been in short supply for years. One estimate suggests the semiconductor industry will need 185 million square feet of advanced substrate manufacturing space by 2025, yet only 145 million square feet of capacity will have been constructed by that time. This 40 million square foot gap is substantial. One Japanese firm anticipates spending $1.6 billion to build a ~2 million square foot substrate manufacturing facility over an 18-month period, implying that $32 billion in global investment in substrate capacity expansion needs to occur to meet forecast demand by 2025.

Leading IC Substrate Suppliers by Country, 2020

U.S. PCB production is also lacking in terms of capacity and technical competitiveness. There are less than 150 PCB suppliers in the country today, down from over two thousand in the late 1990s, and 80 percent of global production capacity is in China while only 4 percent resides in the United States. Similar to ATP, PCB production moved overseas due to the cost competitiveness of firms in Asia and the proximity to electronics assemblers. In particular, there is “negligible capacity” in the United States to produce high-density interconnect PCBs necessary for advanced packaging. Specifically, U.S. additive process capacity to produce high-density substrates of 6 to 50 microns (which would be competitive with firms in Asia) is insufficient to meet U.S. demand.

Assembly, Test, and Packaging

U.S. ATP capacity is limited in terms of number of facilities, capacity, and technological competitiveness. Only 3 percent of global ATP capacity resides in the United States, and this capacity is mainly due to the presence of Intel company-internal ATP facilities and boutique ATP facilities that serve the defense industry. There is a distinct lack of high-volume outsourced assembly and test (OSAT) services in the United States (figure below). The result of this is that the vast majority of chips made in the United States by firms like GlobalFoundries (New York) and Texas Instruments (Texas) are sent to OSATs based in Southeast Asia and China or at company-internal facilities based in the same region. U.S. headquartered integrated device manufacturers (IDM) operate 48 of their 59 ATP facilities outside the United States, most of which are located in the Philippines (11), Malaysia (10), and China (9). For example, though Intel maintains ATP facilities in the United States, it reports that its Vietnamese assembly and test factory is the company’s largest, employing 2,800 in a factory that has seen total investment of $1.5 billion. The company also recently announced plans to construct a $7 billion ATP facility in Malaysia.

Geographic Location and Number of ATP Facilities, 2021

Cross-Cutting Opportunities

The previous section detailed several looming challenges that must be addressed concurrently with efforts to re-shore semiconductor fabrication:

Geographic concentration of global ATP capacity and the associated materials ecosystem in Asia.

A corresponding lack of ATP capacity and the associated ecosystem in the United States.

Competitive firms in Asia that enjoy first-mover advantages and considerable advantage in terms of technology and market share.

This section focuses on options for re-shoring the broader materials and ATP ecosystem, identifying incentives to encourage existing suppliers to expand capacity in the United States or allied countries, and funding innovation, especially in materials science, to create a commercially competitive ecosystem. Specifically:

Fund innovation in upstream materials supply chains. As examples, this section argues that funding innovation in hydrofluorocarbons, photoresist, and recycling of ultra-high purity process gases technologies all merit CHIPS Act funds.

Encourage re-shoring or near-shoring of ATP capacity and the associated ATP ecosystem. As examples, this section argues that directing CHIPS Act funds toward establishing domestic substrate and PCB capacity targeting AI and HPC applications would improve supply chain resilience.

Upstream: Materials Supply Chain Innovation

CHIPS Act funds should focus on promoting innovation in semiconductor materials, beginning with hydrofluorocarbons. HFCs and other fluorinated greenhouse gases have been used in the semiconductor industry since the 1980s. HFCs are used in semiconductor fabrication during the etch/wafer cleaning and chemical vapor deposition processes and are highly valued for their extreme purity. Importantly, more advanced semiconductor fabrication techniques consume (and thus emit) HFCs more intensively. This is because chips are being built on wafers vertically, increasing the density of the circuitry by “putting more layers down and etching more layers off using HFCs.” Efforts to identify replacement chemicals have not been successful, and HFC consumption/emissions are expected to increase substantially as the United States re-shores semiconductor fabrication in the coming years. This trend presents an upcoming supply chain chokepoint for the U.S. semiconductor industry and potentially complicates U.S. commitments to international environmental agreements. The U.S. semiconductor industry “has no alternatives to HFCs yet,” according to a leading industry association, but identifying such alternatives would present a win-win for supply chain resilience efforts and environmental protection goals.

Another set of chemicals for which the semiconductor industry has not yet identified an alternative is photoresist. “Photoresist” refers to a family of customized chemicals that, when deposited on a bare wafer and exposed to patterned light (via a photomask), selectively dissolve and impart a circuit pattern. The production of photoresist is dominated by the Japanese firm JSR Corporation, though other firms in Japan, South Korea, China, Germany, and the United States are also active in the market. Notably, the two main U.S. suppliers are DuPont and an Oregon-based startup called Inpria (now owned by JSR Corporation). Production of extreme ultraviolet lithography (EUV) photoresist, which is used by firms like TSMC and Samsung to manufacture their most advanced chips, is almost entirely concentrated in Asia. While Inpria maintains a U.S. production presence for EUV photoresist, the scale of their production will be insufficient to meet anticipated demand and they are now owned by a Japanese firm. The U.S. firm Dupont is similarly focused on serving clients in Asia, having chosen to expand its EUV photoresist production capacity in South Korea rather than the United States in 2020.

Like HFCs and photoresist, ultra-high purity process gases are intensively consumed during semiconductor fabrication, particularly during the deposition, etch, and lithography stages. Production of these gases resides almost entirely outside the United States. Using CHIPS Act funds to encourage investment in recycling technologies at fabs would result in a win-win for supply chain resilience and environmental protection. The benefits of recycling process gases are well understood: done right, recycling can provide reliable supply at a predictable cost. The costs are equally well-understood: recycling requires investment in supplemental equipment as well as ongoing operating expenses, in addition to developing the know-how. CHIPS Act funds should encourage industry to invest in recycling technologies at the fab level. This could be accomplished through two mechanisms: (1) preference receipt of CHIPS Act funds on applications from proposed fab projects that have a detailed recycling and environmental remediation plan for capturing atmospheric gases as well as ultra-high purity rare gases that exceed current industry best practices and/or (2) fund an industry consortium to develop and commercialize rare gas recycling technologies (separation, pressurization, and/or purification). This consortium could be housed under the National Institute of Standards and Technology’s new metrology initiative funded by the CHIPS Act as NIST’s Fluid Metrology Group already maintains a list of 49 semiconductor process gases.

Downstream: ATP Capacity and Ecosystem

CHIPS Act funds should be directed to encourage creation of a commercially competitive advanced packaging ecosystem. However, because the U.S. ATP ecosystem is almost nonexistent, it is difficult to assess what it would cost to establish a high-volume advanced packaging facility, leading-edge substrate production, and commercially-viable printed circuit board production domestically. News reports and company filings help provide some context, however.

Publicly traded U.S. semiconductor companies’ annual filings indicate their ATP facility locations and estimate the value of those assets in China, which is presumably one of the most cost-competitive locales for them to have established operations. Intel has previously estimated that it would cost anywhere from $650 million to $875 million to relocate its ATP facility from China to another country. Its public financial filings also indicate that it estimates the current value of its China-based ATP facility at around $851 million. Amkor Technology, a leading outsourced semiconductor assembly and test (OSAT) firm as well as Micron, onsemi, Qorvo, and Texas Instruments also own packaging facilities in China and assess these assets are worth anywhere between $200 million and $570 million.

Given China’s low labor rates and favorable subsidies, these costs likely represent a lower-bound of overall facility cost (and, importantly, do not take into account operating expenses). Assuming costs in the United States are at least double, this suggests that if CHIPS Act funds are directed toward re-shoring high volume ATP capacity, U.S. policymakers should expect each new ATP facility would cost somewhere between $750 million and $1.5 billion.

The cost of establishing a substrate facility in Asia similarly represents a lower bound relative to the United States, but is helpful for assessing the overall rough order of magnitude. Samsung Electro-Mechanics (SEMCO), a subsidiary of the South Korean conglomerate, reportedly spent $910 million in 2021 to establish a substrate factory focused on advanced packaging in Vietnam. This is roughly the same cost estimate made by some industry analysts, who believe that a state-of-the-art substrate facility in the United States would cost over $1 billion and take two years to build. In November 2022 a South Korean substrate supplier announced a $600 million substrate facility in Georgia, providing one example of U.S.-specific costs. Alternately, U.S. policymakers could consider near-shoring ATP capacity, PCB and substrate production, and the broader materials ecosystem. Efforts are already underway by some border states in Mexico to increase their participation in the electronics supply chain, and Mexican government officials have announced their intent to offer incentives designed to attract semiconductor suppliers in 2023.

Conclusion

These observations suggest the U.S. government should leverage this unique opportunity and carefully coordinate funding to ensure adequate support is given to upstream and downstream stages of the U.S. semiconductor supply chain. Specifically, funds should be directed to immediately resolve known chokepoints in material supply chains and ATP for which there is no U.S.-based capacity. Funds should also be directed to allies to promote near-shoring of these supply chains where an economic case for re-shoring does not exist. Finally, incentives and funds should be directed toward innovative efforts that will increase overall supply chain resilience.

For more information, read this recent report from Georgetown University’s Center for Security and Emerging Technology.

The views expressed here are my own and not those of employers past or present.